Using Take Profit in Algorithmic Trading for Optimal Results

Using Take Profit in Algorithmic Trading for Optimal Results

Blog Article

Futures trading is an essential the main global economic landscape, providing opportunities for both speculation and hedging. Whether you're a starter or a skilled trader, understanding the fundamentals of Futures trading discount is crucial for navigating that active market. That evaluation offers a thorough look at futures trading, showing key elements for both novices and professional professionals.

What is Futures Trading?

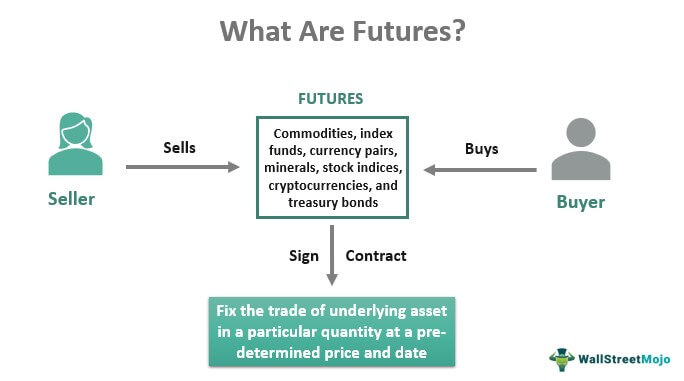

Futures trading requires buying and offering contracts that obligate the customer to buy, or owner to market, a tool at a predetermined cost and time in the future. These contracts could be predicated on a number of main resources such as commodities, indices, or currencies. Futures trading is typically utilized by traders to hedge dangers or even to suppose on cost movements.

How Futures Trading Operates

In a typical futures agreement, two events agree on the price tag on an advantage for a certain future date. For example, a primitive gas futures contract may possibly collection a cost of $50 per barrel for supply in three months. If the price tag on primitive gas rises over $50 during the time of supply, the buyer profits. Alternatively, if the cost lowers under $50, owner benefits.

Futures contracts may be traded on specific transactions, providing a transparent and governed environment. Industry members can often take extended roles (buying) or short roles (selling), relying on their market outlook.

Features of Futures Trading

Among the major advantages of futures trading is leverage. Traders can get a handle on a sizable place with a relatively tiny amount of capital. This power may magnify profits but in addition raise the risk of losses. Futures trading also presents flexibility, as agreements may be dealt on different assets, such as for example materials, agriculture, or financial products.

For hedgers, futures give a way to lock in charges for potential purchases or income, supporting to manage cost volatility. That function is very valuable for companies that rely on fresh resources or commodities in their generation processes.

Considerations for Novices and Authorities

While futures trading gift ideas exciting possibilities, in addition, it bears significant risk. For newbies, it's necessary to know the aspects of industry and the various kinds of contracts before choosing capital. Beginning with small positions and paper trading will help construct experience without revealing oneself to big losses.

For experienced traders, advanced methods such as distribute trading or using futures in conjunction with other devices can provide additional approaches to profit from market movements. But, even experienced experts should stay careful and conscious of the dangers involved.

Realization

Futures trading is a thrilling yet complex economic task that offers options for equally speculation and chance management. By knowledge the basics, applying appropriate methods, and controlling chance effortlessly, traders can understand the futures industry successfully. Whether you are just beginning or have decades of experience, remaining educated and disciplined can help you thrive in this fast-paced environment. Report this page